For the sake of this post, I want to speak specifically to the mistakes of the working population and the realities of retirees in Jamaica. Hopefully,

this information may prevent or curtail the situation where an individual is headed towards a retirement crisis.

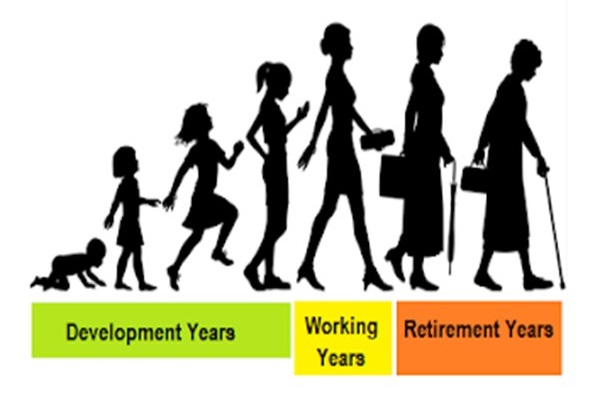

So what is retirement? Retirement is the act of ceasing to work,

whether voluntarily or involuntarily. In Jamaica, the normal retirement age ranges from 55 years to 65 years. However, an individual may opt to retire at any time given that they have made provisions to sustain themselves after retirement.

Also, an individual may retire involuntarily resulting from a situation whereby they are disabled and can no longer work to provide a means of income for themselves.

Having said that, after retirement, there are still living expenses to service which may become a problem if an individual didn't plan for this eventuality. These expenses may include but not limited to household bills,

food and the largest expense for elders after retirement is medical expenses. For those who had made provisions by way of setting aside a portion of their earnings during their working

years would have the means to receive a pension from the sums invested in a pension plan. A pension is a regular payment made to retired persons who had made contributions to a pension scheme.

The pension received now becomes their source of income.

Here are some mistakes made by employees during working life and the realities after retirement:

1. Started saving towards retirement late. (Start as early as possible, preferably at the first job.)

2. Investing only 5% of salary every year. (Consider investing more than the minimum.)

3. Failing to reinvest retirement savings when changing jobs. (Cashing out all or part when changing jobs will adversely impact retirement income.)

4. Failing to do a periodic review of retirement savings after initial sign up.

5. Failing to seek professional advice about your retirement saving options.

1. Pensioners can barely make ends meet, while others don't even have a retirement income.

2. Pensioners don't have enough funds to cover medical expenses - one of the biggest expenses after retirement.

3. Pensioners are unable to save towards an 'emergency fund' after retirement due to the pressures of other expenses.

4. Some pensioners are still in debt after they stop working and still have adult dependents to support.

5. Pensioners today would strongly advise the youth to start their savings and planning for retirement EARLY.

If you have not yet started saving towards your retirement, you can start now. Whether you are self-employed or the company to which you are employed don't have a pension arrangement, you have the option to start saving in an Approved Retirement Scheme (ARS) for individuals. Retirement can be a wonderful experience or a rude awakening... it's all up to you.

Other Retirement Posts

Susan Scarlett is the executive assistant helping busy professionals with their to-dos. She also enjoys blogging about topics of interest, sewing, and volunteering.